what is tax assessment in real estate

Homeowners capture the added value from betterments in the. Property owners are provided with an annual official notice of the assessed value of their real property for local tax purposes.

Rep Mazzochi Assessor Boltz Hosting Property Tax Assessment Seminar

All sales of real property in the state are subject to REET unless a specific exemption is claimed.

. The 2022 assessments are available on the website. Your propertys assessment is one of the factors used by your local governments and school district to determine the amount of your property taxes. Typically betterment assessments cannot be deducted from income tax the way taxes for repair projects can be.

Real estate excise tax REET is a tax on the sale of real property. Individual Property Assessment Roll Data. Code of Virginia 581-3330.

Tax rates differ depending on where you. The Citys Final Assessment Roll lists the assessed value of every property. Net capital gains from selling collectibles are taxed at a.

Property taxes are based on the value of real property. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Reporting and Paying Tax on US.

Tax Classes 2 3 and 4. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. Property tax is a tax assessed on real estate.

Real Estate Assessment Notices. The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28 rate. Which rate your capital gains will be taxed depends.

2 days agoReal estate taxes in Mississippi are determined by local tax authorities based on the home values in the individual counties cities or districts which means the tax rate varies. If you are uncertain about the. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or.

A special assessment is a levy levied by public bodies against real estate parcels in the United States to fund certain public projects. The property tax is an ad valorem tax meaning that it is based on the value of real property. Statistical Summary PDF.

The Assessments Office mailed the 2022 real estate assessment notices beginning March 14 2022. This tax is imposed in a geographical area. Understanding Real Estate Assessments.

While real estate taxes cover only taxes on real property like a condo home or rental property personal property taxes include tangible and movable personal property. Tips on Rental Real Estate Income Deductions and Recordkeeping Questions and answers pertaining to rental real estate tax issues. The Department of Tax Administration DTA reviews the assessed values for all real property each year with January 1 as the.

The tax is usually based on the value of the property including the land you own and is often assessed by local or municipal.

Assessed Value Vs Fair Market Value Massachusetts Home Values

5 Step Process To Win A Lower Property Tax Assessment Youtube

Are My Property Taxes Too High Real Estate Tax Appeals Lawyers

Understanding Your Property Tax Assessment 828 Real Estate

The New Age In Indiana Property Tax Assessment

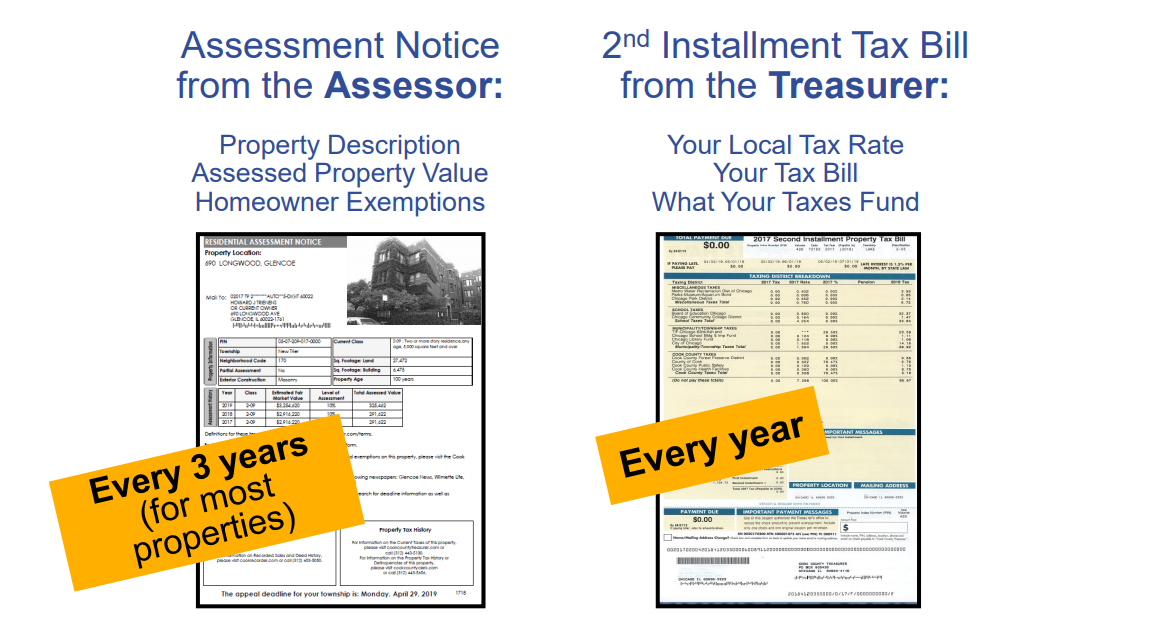

Your Assessment Notice And Tax Bill Cook County Assessor S Office

2021 Real Estate Assessments Now Available Average Residential Increase Of 4 25 News Center

Decatur Twp Assessor Assessment Process

New York City Property Tax Assessment A Deep Dive Into How It S Done And How To Appeal Marks Paneth

Challenging A Property Tax Assessment

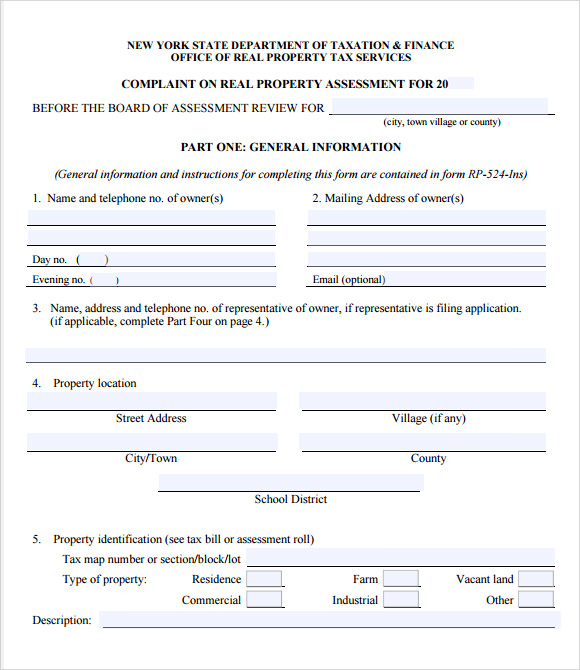

Free 5 Tax Assessment Samples In Pdf

Automated Home Valuation Avm And What It Can Do For Your Tax Assessment

:max_bytes(150000):strip_icc()/GettyImages-13484945191-47df439c13e74fcab1c078592813ac27.jpg)

What Is A Property Tax Assessment

Tennessee Property Data Home Page

How Property Tax Appeals Shift The Financial Burden Crain S Chicago Business

Assessed Value Vs Fair Market Value Massachusetts Home Values

Real Estate 101 Knowing Your Property Value And Challenging Your Tax Assessment Cohen Seglias

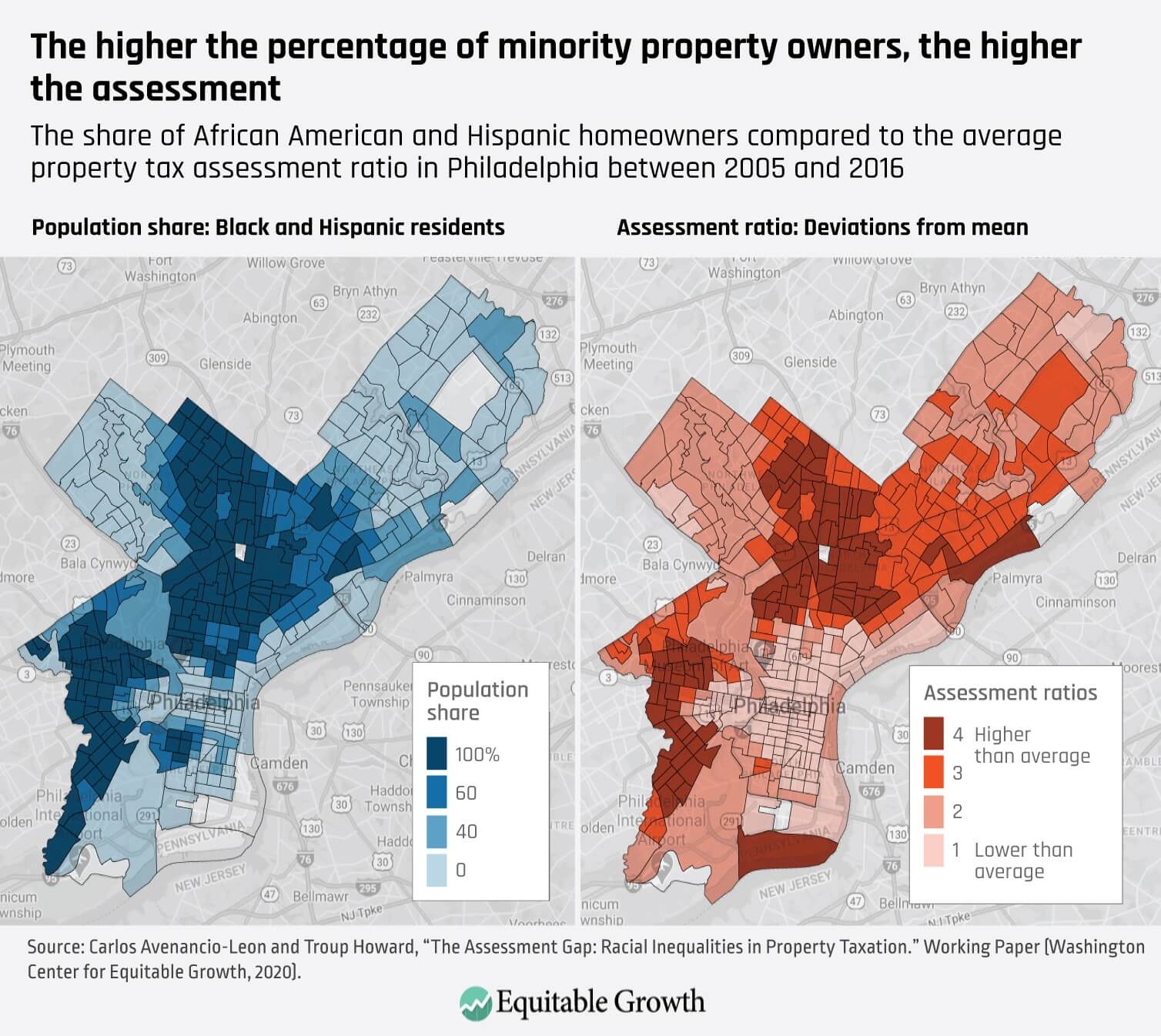

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

/shutterstock_262923179-5bfc3a3f46e0fb00265fdad8.jpg)